Are you planning to buy a property? Understanding the property registration process is key to a safe and secure transaction. Do you live abroad and find it challenging to register a property in your name, worrying about potential fraud? This is where Form 32A comes in—a crucial part of property registration that protects buyers from impersonation and unauthorized transactions.

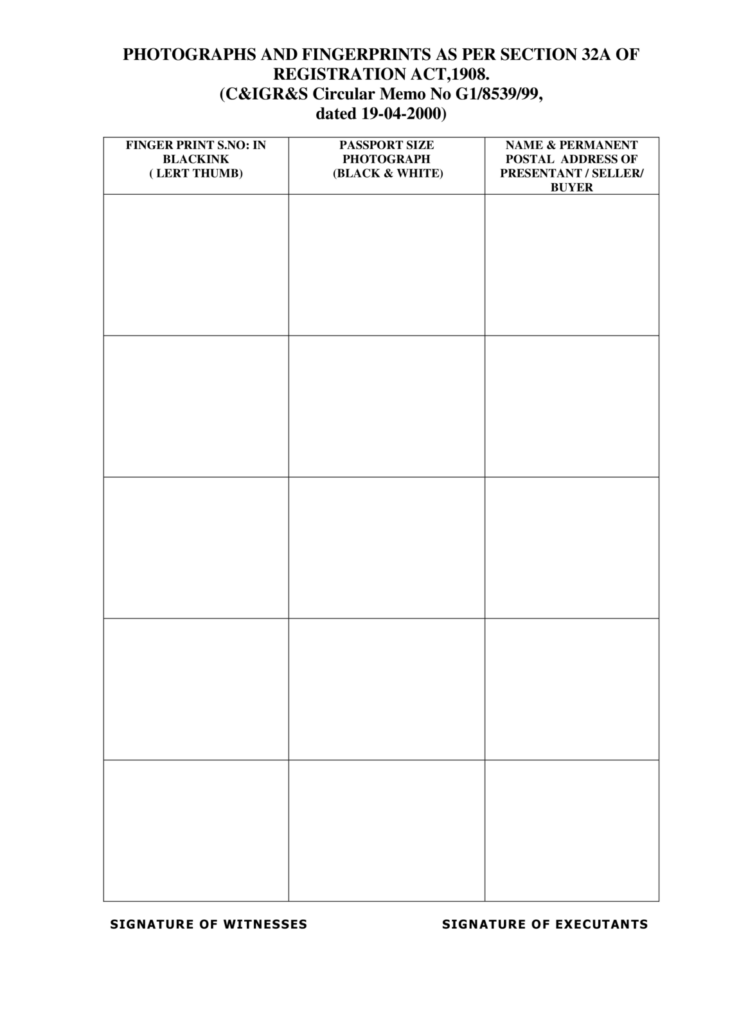

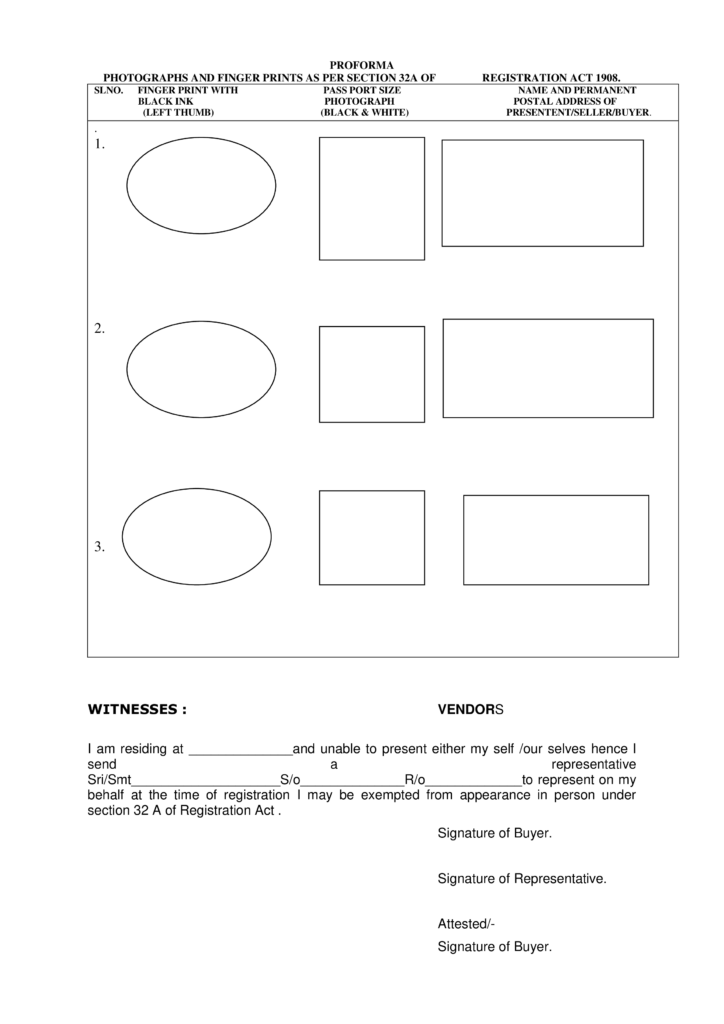

The property registration process is based on the Registration Act 1908 and it helps to identify the people involved in the transaction of the property for both seller and buyer who they claim to be. Verification needs biometrics, photo authentication, identification and declaration

Form 32A is grounded in the Registration Act of 1908 and was implemented in Telangana and Andhra Pradesh in the early 2000s which makes property registration safer and more transparent though this property differs between states and remains an important mechanism to confirm identities and prevent impersonation in property deals.

IMPORTANCE OF FORM 32A

Imagine you are buying a property and later find that the seller is a fraud, and property fraud is the real nightmare! And that’s where Form 32A comes in. Form 32A verifies both buyer and seller they claim to be. With strict requirements for photo identification, Biometrics, and personal identification. This form helps prevent fraudulent property transactions.

Form 32A under the Registration Act of 1908 plays a crucial role in the property registration process in India, It typically involves the authentication of the persons involved in the property transactions.

Process of Filling out Form

Here is the step-by-step process to ensure you don’t miss out on crucial details. Here is how you exactly fill out the form:

Here is the step-by-step process to ensure you don’t miss out on crucial details. Here is how you exactly fill out the form:

- Gather the right documents, such as ID proofs, property details, or any other documentation that supports the transaction.

- You start filling out the form will ask for the details of the involved persons, And confirm the information through, biometrics, Thumbprints, photos, and signatures.

- Re-check and pay attention to every section. Missing details can lead to form rejection and that can be frustrating!

- To avoid unnecessary issues you need to double-check the details.

It also plays an important role for NRIs in property transactions, especially when the person is not physically present in India for the registration. To make property dealing more convenient and secure in India, for NRIs And maintain the property transactions more transparent. This form 32A is a crucial part of property registration, which adds a layer of security to property transactions.

To protect buyers and sellers from fraud by using biometrics and photo identification. It is a strict rule in Telangana and Andhra Pradesh to comply with these forms. Those involved in property transactions in India or abroad need to understand and comply with Form 32A’s requirements.

At flivv we prioritize security and peace of mind. We have successfully registered many properties through Form 32A. By ensuring accuracy and through identifications of the people who can’t be physically present at the time of property registration. We make sure that the buyers and sellers are fully authenticated.

Our clients have consistently spotlighted for the clarity and ease we provide them for property registration, from identification to the signatures Flivv handles all the steps seamlessly.

In today’s tech world, accurate documentation, security, and transparency are the most important things. Flivv Developers ensures compliance with the latest regulatory standards and simplifies the complexities of property registration for our clients.